Market Overview:

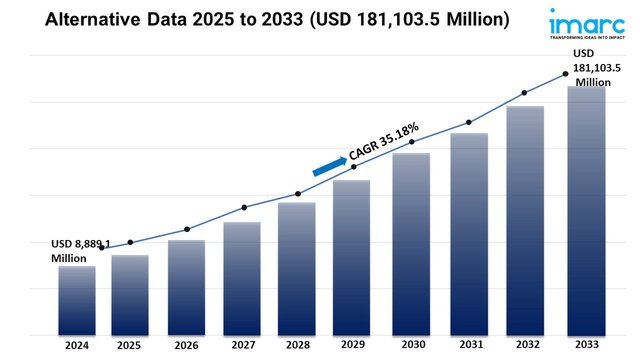

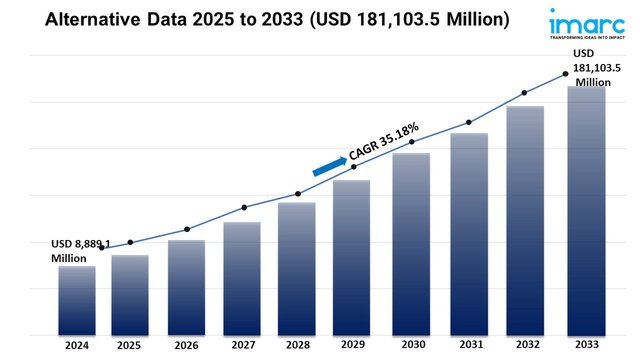

The alternative data market is experiencing rapid growth, driven by rising demand for unstructured data, ai-driven data monetization, and regulatory scrutiny & compliance. According to IMARC Group's latest research publication, Alternative Data Market Report by Data Type (Mobile Application Usage, Credit and Debit Card Transactions, Email Receipts, Geo-Location (Foot Traffic) Records, Satellite and Weather Data, Social and Sentiment Data, Web Scraped Data, Web Traffic, and Others), End Use Industry (Transportation and Logistics, BFSI, Retail and ECommerce, Energy and Utilities, IT and Telecommunications, Media and Entertainment, and Others), and Region 2025-2033. The global alternative data market size reached USD 8,889.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,81,103.5 Million by 2033, exhibiting a growth rate (CAGR) of 35.18% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/alternative-data-market/requestsample

Our report includes:

Factors Affecting the Growth of the Alternative Data Industry:

The alternative data market is seeing a rise in demand for unstructured data. This includes satellite imagery, social media sentiment, and web scraping outputs. Investors and companies use these datasets to gain real-time insights. They focus on consumer behavior, supply chain issues, and competitive intelligence. Unlike traditional structured data, unstructured data provides a richer view of market trends. This drives adoption among hedge funds, retail, and healthcare sectors. However, challenges like data normalization and privacy concerns persist. These issues push firms to invest in advanced AI and machine learning tools for better processing.

Artificial intelligence is changing how companies collect, analyze, and profit from alternative data. More firms are using AI to turn raw data into useful insights. This helps with predictive analytics and automated decision-making. This shift is especially strong in quantitative trading. AI models look at different datasets, such as credit card transactions and IoT sensor data, to predict market trends. As AI improves, businesses focus on cloud-based solutions. These can manage large datasets, creating new revenue for data providers and helping smaller firms compete.

The rapid growth of alternative data is leading regulators to tighten oversight. They want to ensure ethical sourcing and usage. Concerns about data privacy, like GDPR and CCPA, are pushing for stricter compliance. Companies now focus on clear data provenance and audit trails to reduce legal risks. This change encourages partnerships between data vendors and compliance tech firms. These partnerships help ensure datasets meet regulatory standards while keeping a competitive edge. As scrutiny increases, the market may consolidate. Only the most compliant and high-quality providers will succeed.

Leading Companies Operating in the Global Alternative Data Industry: